| Financial freedom | Retirement | ETFs |

|---|---|---|

| TFSA | Offshore | Property |

| Markets | Investment terms | Fees |

Topic: ETFs

Satrix gave South Africans their first ETF - the Satrix 40 - in 2000, making it possible to own 85% of the SA stock market back then. On 10 November 2021 Satrix launched another ETF - the Satrix Capped All Share ETF - that makes it possible to own even more of the SA stock market. If you already have the Satrix 40 in your portfolio should you switch?

Nowadays, when it comes to any new money that I invest offshore, I like to keep things simple and use only two widely diversified global ETFs - the Satrix MSCI World and the Satrix MSCI Emerging Market (EM) ETF. Recently CoreShares launched a world ETF that combines developed and emerging market stocks. I've compared the new fund to my existing Satrix combo to find out whether it's worth switching.

The CoreShares Total World Stock ETF not only combines developed market (DM) and emerging market (EM) countries in one ETF, it also adds global small caps – a first in South Afica. This is a great one-stop ETF for your foreign equity exposure needs. How does it compare to the Sygnia Itrix S&P Global 1200 ESG ETF?

This much we know is true: at the first level, the fund level, an ETF is almost always cheaper than a unit trust tracking the same index. But at the next level, the trading platform or product level, access fees need to be added to the ETF costs for a fair comparison, as it’s impossible to buy an ETF without this next level of fees. Comparing ETF and unit trust fees at fund level only is a very common mistake.

Mr Money Mustache, the Frugalwoods and almost every FIRE blogger I know choose index tracking funds (passive) for their investment portfolios. This ‘everybody is doing it’ argument is not the one that convinced me to start switching into passive, though. But when Warren Buffett started recommending index trackers, I found myself paying attention.

There are a few misconceptions around ETFs vs unit trusts going around. One is that an ETF is passive and a unit trust is always active. The other more worrying untruth is that ETFs are always cheaper than unit trusts. When looking at the overal cost on fund and platform or brokerage level, a unit trust often beats an ETF cost-wise. Which should you choose: ETF or unit trust?

I've noted that some of my fellow travellers on the road to financial freedom have the 'swiss army knife' of investments - only one ETF

(exchange traded fund) to do everything for them. It's normally the Satrix MSCI World or Ashburton 1200. But is a portfolio of one ETF enough?

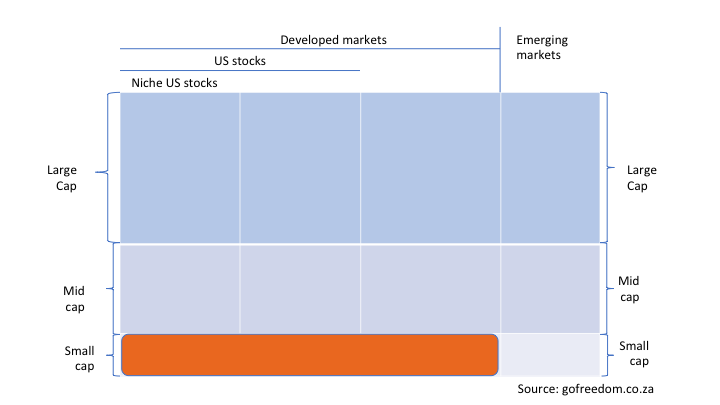

It’s time to delve into some ‘index geography’. Once you can confidently point out where on the global equity index 'map' your ETF lies, knowing how to further diversify your global portfolio becomes a breeze.

While the unit trust industry has too many balanced multi asset funds, the ETF industry has significantly less to choose from. And maybe you're not a fan of any of the brands that put those index tracking balanced funds together. You'll need to do more research and it's clearly more work, but if you'd rather build your own multi asset ETF portfolio, this is how you go about it.

Let’s face it, the unit trust industry has way too many funds. Arguably, the ETF industry is heading the same way. The choice of which underlying fund to pick for your account is overwhelming for new and old investors alike. How do you methodologically go about choosing an ETF or unit trust fund you feel confident is the right one for you?