What’s the difference between an ETF and a unit trust?

By Lizelle Steyn

21 February 2021

Photo credit: cottonbro

I regularly come across investors who know what a unit trust is but haven’t heard of an ETF yet. Only vaguely interested in the answer, they’re normally happy with ‘it’s similar to a unit trust, but a newer type of investment’. True, unit trusts have been around since the 1930s and ETFs only since the 90s, but there are more important differences between an ETF and a unit trust than their age.

Misconception #1: An ETF is passive and a unit trust is active

Ten years ago, when very few index tracking (passive) unit trusts existed in South Africa, this distinction would have been true. Now there’s a whole range of unit trusts tracking different indices or a combination of indices at a low cost.

Misconception #2: An ETF is always cheaper than a unit trust

This is only true at a fund level. An ETF and a unit trust are both funds. In other words, they’re portfolios made up shares/bonds/cash or a combo of these. If you compare an ETF and a unit trust tracking the same index, eg the MSCI World, the total investment cost should be lower for the ETF. Satrix is a good example here because they offer both an ETF and a unit trust to track the MSCI World index. If you download the MDD (fact sheet) for both products, you’ll see the total investment cost (TIC) at a fund level was:

- 0.35% for the ETF vs

- 0.9% for the unit trust at the end of 2020.

That’s unfortunately not where the costs end.

I cannot stress enough how important it is to also include the costs incurred when buying and selling the fund:

- With a unit trust, you don’t need a broker and you can bypass a platform, buying directly from the unit trust management company.

- With an ETF, you need to pay additional brokerage/transaction costs plus you have to consider the size of the bid/offer (buy/sell) spread (a ‘hidden’ cost which could be substantial). Depending on who you use, your total cost for the ETF could work out disturbingly more than what you see on the MDD (more detail on this later).

Another fallacy I see being touted by ETF punters is that unit trusts charge upfront fees. Those days are long gone. In the 1990s Allan Gray was the first unit trust management company in South Africa to abolish initial fees and others had to follow to remain competitively priced. Today you need advanced investigative powers to find a unit trust which still charges initial fees on a fund level, although they exist and need to be avoided. (We’re not talking here about any initial fees – always optional - which you might have negotiated with your adviser for advice. Adviser fees have nothing to do with the fund’s pricing model.)

Enough about the misconceptions around an ETF vs unit trust. What are the real differences between an ETF and a unit trust?

Table: ETF vs unit trust

| ETF | Unit trust | |

|---|---|---|

| You buy | Shares in a portfolio/fund | Units in a portfolio/fund |

| You have access to | Various individual indices (passive) or baskets of indices either bought just like that or inside a tax-efficient wrapper, specifically TFSA or RA in the current ETF environment | A wider range of options: indices (passive); baskets of indices; actively managed funds; hedge funds bought just like that or inside a tax-efficient wrapper, specifically TFSA, RA, preservation fund, or endowment policy in the case of unit trusts |

| Most important laws applicable | Collective Investment Schemes Act; Companies Act; various tax laws | Collective Investment Schemes Act; various tax laws |

| Managed by | ETF provider | Unit trust management company (manco) |

| Accessed via platform or broker | Compulsory | Optional – can buy directly from manco |

| Pricing | Changes throughout the day – can vary significantly depending on time of day bought or sold, providing opportunity to ‘time the market’ for frequently traded ETFs | Priced only once a day – buyer/seller doesn’t know price beforehand |

| Bid-offer/buy-sell spread (extra cost to investor) | Can be large for illiquid (less frequently traded) ETFs | None |

| Liquidity | Liquidity varies from low (a bad thing) to fairly high | Highly liquid |

| Performance reporting | Profit or loss often not annualised (that’s a problem) | Annualised returns (easier to compare to a bank account or deposit) |

| Transparency | Underlying holdings shown daily | Shown quarterly only |

Source: gofreedom.co.za

Essentially, a unit trust is a fund divided into units. An ETF is a fund divided into shares, which trade on a stock exchange.

Similarities between an ETF and unit trust

There are also many similarities between an ETF and a unit trust:

- As mentioned before, they both exist to make it easy for retail investors to pool small amounts of money together to be able to buy sometimes large and expensive stocks, like Apple and Naspers.

- They’re both heavily regulated to protect retail investors’ money.

- Both can easily be bought online nowadays.

- The tax treatment is almost identical.

- Both give investors the option to choose whether they want to receive income – like dividends and interest paid out by the fund – in their bank accounts or whether they want it all to be reinvested in the fund. (There are a few specific ETFs and unit trusts – mostly ones that invest offshore - which are the exception and will only reinvest income.)

- Both can be wrapped in a tax-free savings account (TFSA) or RA for tax benefits.

More about the cost difference between an ETF and a unit trust

One of the marketing triumphs of ETFs is that it’s widely believed that they’re cheaper than unit trusts. But that’s only true in very specific instances. In the end the only cost that really matters is the effective annual cost (EAC) – that is the true total fees and costs an investor is paying on average per year.

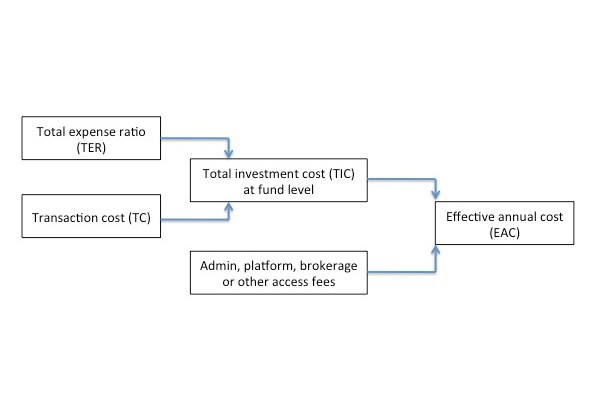

Investors who only look at the total expense ratio (TER) on a fund’s minimum disclosure document (MDD) or fact sheet, unfortunately often believe that’s the only fee. (The ‘total’ part is misleading.) TER relates to the fund or investment management (also called asset management) of the fund. In fact, it’s not even the total investment cost (TIC) at fund level; to get to the TIC you need to add the transaction cost as stated on the MDD to the TER. Important: The TER, transaction cost and TIC can be found on the fund’s MDD. For the overall cost of the product you’re buying, you need to ask the product provider for the EAC or use their online EAC calculator.

How to get to an ETF or unit trust's all-in fee, the EAC:

Source: gofreedom.co.za

When comparing the total cost of an ETF vs a unit trust, ask for the EAC

The only fee that matters is the effective annual cost (EAC), the overall cost that you’ll be paying on the product. Your product provider needs to provide you with the EAC on request. I’m going to use Satrix in this ETF vs unit trust EAC comparison because their online EAC calculator is easy to use. Let’s look at the EAC in a few different scenarios.

EAC for the Satrix MSCI World unit trust:

| Invest for 1 year | Invest for 3 years | Invest for 10 years | |

|---|---|---|---|

| Lump sum of R10 000 | 0.97% | 0.97% | 0.97% |

| Lump sum of R100 000 | 0.97% | 0.97% | 0.97% |

| R1 000 per month | 0.97% | 0.97% | 0.97% |

| R10 000 per month | 0.97% | 0.97% | 0.97% |

EAC for the Satrix MSCI World ETF:

| Invest for 1 year | Invest for 3 years | Invest for 10 years | |

|---|---|---|---|

| Lump sum of R10 000 | 1.17% | 1.03% | 0.98% |

| Lump sum of R100 000 | 1.17% | 1.03% | 0.98% |

| R1 000 per month | 1.35% | 1.09% | 0.99% |

| R5 000 per month | 1.35% | 1.09% | 0.90% |

| R10 000 per month | 1.35% | 1.09% | 0.79% |

EAC for the Satrix Top 40 unit trust:

| Invest for 1 year | Invest for 3 years | Invest for 10 years | |

|---|---|---|---|

| Lump sum of R10 000 | 0.66% | 0.66% | 0.66% |

| Lump sum of R100 000 | 0.66% | 0.66% | 0.66% |

| R1 000 per month | 0.66% | 0.66% | 0.66% |

| R10 000 per month | 0.66% | 0.66% | 0.66% |

EAC for the Satrix 40 ETF:

| Invest for 1 year | Invest for 3 years | Invest for 10 years | |

|---|---|---|---|

| Lump sum of R10 000 | 0.96% | 0.82% | 0.77% |

| Lump sum of R100 000 | 0.96% | 0.82% | 0.77% |

| R1 000 per month | 1.14% | 0.88% | 0.78% |

| R5 000 per month | 1.14% | 0.88% | 0.69% |

| R10 000 per month | 1.14% | 0.88% | 0.58% |

Key take-out: the longer you invest, the cheaper an ETF becomes.

In all my fee comparisons I assume you’re not using an adviser and that you’re buying the unit trust directly from the unit trust management company (manco).

Satrix’s EAC calculator shows that the EAC is constant for a unit trust, irrespective of investment term or amount invested. That’s because – unlike with an ETF - there’s no per-transaction fee. With an ETF the EAC would vary depending on:

- how long you stay invested

- how much you invest, and

- whether it’s a lump sum or monthly investment

Whether the ETF or unit trust is cheaper therefore partly depends on the above three factors. The other factor is whether you’re buying the unit trust directly from the manco or through a platform. If you’re using a platform, the ETF would generally work out slightly cheaper. If you’re going directly to the manco, it really depends on the specific scenario. Investing smaller amounts and/or investing for shorter than 10 years often lead to the unit trust working out cheaper than the ETF.

I was surprised by how much you have to invest – even over a period as long as 10 years – for the ETF to become cheaper.

An even deeper dive into the cost difference between an ETF and unit trust

For those who are interested in why there’s such a big gap between the TER on an ETF’s fund fact sheet and its EAC, here’s an in-depth article on tracking an index via an ETF vs unit trust by the CEO of Sygnia. It was written in 2015 and outdated in terms of the size of the fees (ETFs were much more expensive back then.) But it gives insight into the extra layers of fees that market makers, brokers and trading platforms add to an ETF. There are also more index-tracking unit trusts now than there were in 2015, which put pressure on these funds to become more competitively priced over the years.

A short and sweet summary of the difference between an ETF and unit trust

For those who feel I’m going into too much detail here with my comparison between ETFs and unit trusts, there are two good resources that keep their summary of the difference between an ETF and a unit trust short and simple:

ETF or unit trust – which should you choose?

Depending on your needs and the reason why you’re investing, sometimes an ETF offers more benefits and sometimes a unit trust will give you exactly what you need at the lowest cost. If, for example, you need a preservation fund on leaving your employer’s retirement fund, you’ll battle to find a preservation fund provider in South Africa that offers ETFs. If you want an actively managed fund, you’ll also need to use a unit trust. Multi asset ETFs exist but are sown sparsely at the moment. So, if you want someone else to actively manage your asset allocation inside a diversified fund, you’ll probably also choose a unit trust, of which there are hundreds of multi asset options in South Africa. On the other hand, if you have ‘day trader’ in your blood, the tradability of an ETF throughout the day at different prices would appeal to you. And knowing the price at which you’re buying is a perk.

A few of the differences between an ETF and a unit trust are material. Choosing an ETF above a unit trust based on only one difference, the cost, can boomerang. The sweeping statement ‘ETFs are cheaper than unit trusts’ ignores the fact that there are many ETFs and unit trusts tracking the same index. And often buying the unit trust straight from the unit trust management company is cheaper. The EAC calculator doesn’t lie.