Coreshares Total World vs Sygnia S&P Global 1200 ESG

By Lizelle Steyn

27 April 2021

April 2021 was a busy month for the South African ETF industry. A few new ETFs were announced. Among them are two interesting global ETFs, the Sygnia Itrix S&P Global 1200 ESG ETF, with its sustainable investing focus, and the CoreShares Total World Stock ETF, offering the most comprehensive global coverage yet to South Africans. How do these two ETFs compare?

Table 1: Coreshares Total World Stock vs. Sygnia S&P Global 1200 ESG

| Sygnia S&P Global 1200 ESG | Coreshares Total World Stock | |

|---|---|---|

| Asset class | Global equity | Global equity |

| Number of countries | Currently not more than 30 | 49 |

| Markets | Developed (95%) and emerging markets (5%) | Developed (89%) and emerging markets (11%) |

| Size of companies | Large cap only | Large cap; mid cap; and small cap |

| Number of shares | +/- 750 (less than the 1200 in ‘parent’ index due to ESG exclusions) | +/- 9000 |

| % of world market | About 70% | About 98% (micro shares and frontier markets excluded) |

| Index tracked | S&P Global 1200 ESG | FTSE Global All Cap |

| Environment, social, governance (ESG) filter | Yes | No |

| Top 5 companies | Apple (5%) Microsoft (5%) Amazon (4%) Alphabet (3%) Facebook (2%) |

Apple (3%) Microsoft (3%) Amazon (2%) Alphabet (2%) Facebook (1%) |

| Top 3 countries | Information not available | US (57%) Japan (7%) China (5%) |

| Target total expense ratio (TER) | 0.35% excluding VAT | 0.29% excluding VAT |

| Transaction cost in the fund (TC) | Not yet known, but likely to be higher than if a feeder fund was used | Not yet known but should be low, being a feeder fund |

| Brokerage and other platform costs when investor buys and sells | Depends on the trading platform chosen by investor. Expect tighter (better spreads) on the A2X exhange than on the JSE listing. | Depends on the trading platform chosen by investor |

| Offshore fund into which it feeds | No feeder fund – Sygnia is responsible for fund management | Vanguard Total World Stock ETF |

| Tax efficiency | Information not available | Neutral – same as had investor bought individual shares in US |

| Foreign dividend withholding tax (DWT) drag on performance | Information not available | 0.13% lower performance due to tax than had it fed into an Irish domiciled fund (but Irish fund would have meant higher fees) |

Source: gofreedom.co.za | CoreShares | Sygnia | The ETF Investor

CoreShares Total World Stock ETF – a first to offer global small caps

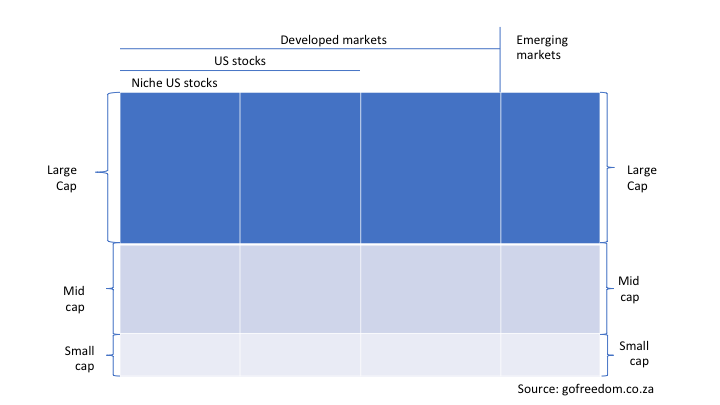

Before, to get both developed and emerging market (EM) exposure, and large cap and mid cap stocks, I had to buy both the Satrix MSCI World and the Satrix MSCI EM ETFs. These are still good products and I’m keeping them in my portfolio. Here’s a reminder of which global ETFs cover which parts of the globe and what terms like ‘EM’, ‘large cap’ and ‘small cap’ mean: How to diversify your global equity ETF portfolio like a pro.

Now, the CoreShares Total World Stock ETF not only combines developed market (DM) and EM countries in one ETF, it also adds global small caps – a first in South Afica. This is a great one-stop ETF for your global equity exposure needs.

Graph 1: The world map and main 'regions' of global equity ETFs

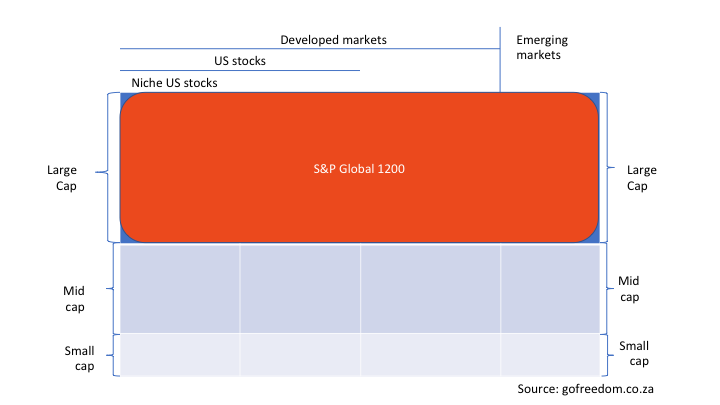

How an ESG filter shrinks a portfolio of 1200 stocks to 750

If you’re confused about why the Sygnia S&P Global 1200 ESG ETF has approximately 750 shares, but has ‘1200’ in its name, that’s because the S&P Global 1200 index is the parent index. From the full index with its 1200 shares, companies that are involved in industries such as coal, weapons and tobacco are excluded. That’s how an ESG filter shrinks a portfolio of 1200 stocks to 750. The shares that remain can also be downweighted due to unsustainable business practices putting them at risk of litigation or going out of business somewhere in the future. ESG stands for ‘environmental, social and governance’ factors. Gender issues and diversity and inclusion are also considered, and it’s about much more than just being ‘green’.

Graph 2: The coverage of the S&P Global 1200 - the parent index of the Sygnia S&P Global 1200 ESG ETF

TER is a drag on fund performance

TER (total expense ratio) is often the biggest drag on performance and the main reason an ETF rarely beats the index return. CoreShares has done everything in its power to come to market with the ETF cost leader for an ETF giving both DM and EM exposure. Note that for both the Sygnia S&P Global 1200 ESG and the Coreshares Total World Stock ETF we currently have only a target TER, as TER looks back at an ETF’s main expenses and will only be available on the fund fact sheet at the first anniversary of the products. The ETF provider may sponsor some of the fund costs if the actual TER experienced by the fund turns out to be higher than the target TER at launch, but this target TER is not guaranteed.

TER is not the only fee associated with an ETF. I’ve posted before on how to find all the fees and costs involved with your chosen ETF.

Transaction cost is an additional drag on performance

The CoreShares Total World Stock ETF keeps the transaction cost (TC) of the fund low by using a feeder fund structure. The transaction cost is higher when an ETF provider doesn’t use a feeder fund. It then has to buy the underlying shares directly, and buy and sell them every quarter to rebalance back to the index benchmark – like Sygnia does.

Tax is the ‘hidden’ drag on performance

Unlike fees, foreign withholding tax receives so little attention in the media, it might as well be the dark side of the moon. But every ETF and unit trust investor with foreign stock market exposure pays withholding tax. Even if you’re invested offshore via a local tax-free savings account. The exact percentage depends on the jurisdiction of your shares and/or offshore fund into which your local feeder fund feeds. It gets paid away to foreign tax collectors (other countries’ equivalent of SARS) before the foreign dividends hit your investment account. Importantly, it reduces the return of your investment.

If you’re baffled by how you could possibly be paying tax on your tax-free savings account, I’ve previously written an article on foreign withholding tax and your TFSA. The bottom line: SARS may say you don’t have to pay tax, but the foreign tax collectors don’t give a damn; they want their withholding tax and take it from the dividend before you even see it.

Where SA-based global feeder funds are concerned, feeding into an Irish-based UCITS fund results in lower foreign withholding tax than feeding into a US-based fund.

The verdict: Coreshares Total World Stock vs. Sygnia S&P Global 1200 ESG

If you want the widest global coverage at the lowest cost, you can’t beat the CoreShares Total World Stock ETF. Just be mindful of the small drag on performance of the foreign withholding tax. If you’re willing to let go of mid and small cap stocks for the sake of a more sustainable investment product, the Sygnia S&P Global 1200 ESG ETF is not a bad choice. The CoreShares Total World Stock ETF spreads its net as wide as possible; the Sygnia S&P Global 1200 ESG ETF ensures your catch of the day is not on the ‘red list’.

Related blog posts

How to DIY asset allocation and build your own ETF portfolio

20 January 2021

While the unit trust industry has too many balanced multi asset funds, the ETF industry has significantly less to choose from. And maybe you're not a fan of any of the brands that put those index tracking balanced funds together. You'll need to do more research and it's clearly more work, but if you'd rather build your own multi asset ETF portfolio, this is how you go about it.