Surprise, I do pay tax on my TFSA

By Lizelle Steyn

7 March 2021

Credit: Andrea Piacquadio

Since tax-free savings accounts were launched in 2015, I’ve been under the impression that they are entirely tax-free, other than the well publicised 40% penalty if you exceed your annual contribution limit. But that’s a penalty for breaking the rules and not a tax, some would say. And there’s estate duty on a tax-free savings account (TFSA). But that’s your estate, not you, one could argue. However only now, six years after buying my first TFSA with Allan Gray, I find out that actually I do pay tax on my TFSA. Real tax. While still alive and not breaking any rules.

TFSA investors pay withholding tax on foreign dividends and interest

This year I picked a global equity fund, the Satrix MSCI World Feeder Fund, for my TFSA but wondered how the Allan Gray TFSA gets around the dividend withholding tax charged on the offshore listed companies in which I’m invested via the fund. It turns out, there’s no avoiding it. TFSA investors do pay withholding tax on foreign dividends and interest.

What is withholding tax?

As the name suggests, a withholding tax is withheld and paid over to the taxman before it reaches the investor. The investor receives the net income (dividend or interest) after the withholding tax. Effectively, the tax authority is not leaving the tax declaration to the individual; it rather requests the institution in which individuals invest to collect the tax on their behalf.

Withholding tax is still relatively new in South Africa. SA tax residents don’t pay a specified withholding tax on local interest. However, since 2012, we've been paying a withholding tax – at first 15%, now 20% - on dividends declared by locally listed companies, if NOT invested via a TFSA or a retirement fund. Inside a TFSA, there’s no withholding tax on dividends declared by a company listed in South Africa.

But, outside of South Africa, a withholding tax can apply to:

- Dividends; and/or

- Interest

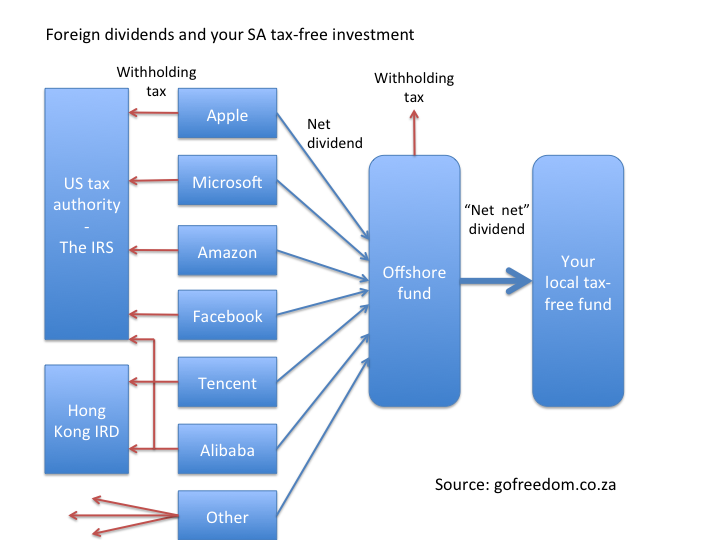

So, if you are invested in, for example, Apple shares via your chosen TFSA unit trust fund or ETF, Apple would have had to pay 30% withholding tax to Uncle Sam first and only the net dividend lands in your fund.

The offshore-domiciled fund may have to pay withholding tax too

There’s often an extra ‘layer’ involved with offshore investing via a South African asset manager. In my case, the locally domiciled Satrix MSCI World Feeder Fund invests in the Satrix World Equity Tracker Fund, which is based (domiciled) in Ireland. Some of the companies held by the offshore-domiciled fund will distribute 100% of their dividends to that fund. Depending on what tax rules your particular offshore fund have to comply with, a portion of those dividends might then need to be paid by the offshore fund to its tax authority. And it’s only after the underlying companies, like Apple, Microsoft and Facebook, PLUS the offshore fund have made all their respective withholding tax payments, that your locally-domiciled TFSA fund receives the final net income.

It doesn’t matter if you chose a unit trust or an ETF with some global assets in the portfolio, the tax principles remain the same.

It also doesn’t matter if you get your offshore exposure via a feeder fund or not. According to Allan Gray, even foreign investments without a feeder fund structure, would still be liable to pay over the withholding tax to their respective tax authorities offshore.

Lighten up, we’re still paying less tax on foreign dividends in a TFSA

Receiving your foreign dividends via a TFSA is still way better than having a standard, taxable product. With a non-TFSA standard product, both the offshore tax authority and SARS ‘hit’ you:

- Step 1: The IRS gets either R30 or R15 (depending on which tax agreement applies) of every R100 of dividends on your Apple share.

- Step 2: SARS then also charges income tax on a portion of the net dividend (remaining R70 or R85) paid to you.

With a TFSA, you are only paying the tax in Step 1. SARS has made the net dividend receivable on this side free of tax.

Stanlib provides an example of how foreign dividends are taxed as part of South Africans’ income – when outside of a TFSA. You might be able to claim back the foreign withholding tax, but probably shouldn’t try this without the help of a tax practitioner.

If you’re investing offshore, is a TFSA worth it?

Despite my slightly disconcerting discovery this year, I think a TFSA is still a great product and most aspects of a TFSA are tax-free. It’s only withholding tax on foreign holdings that can’t be avoided. To be specific, inside a TFSA you don’t pay:

- Tax on local interest

- Tax on dividends from companies listed in SA only

- Capital gains tax

- Further tax on the ‘net of withholding tax’ foreign dividends

- Further tax on the ‘net of withholding tax’ foreign interest

- Securities transfer tax

Compared to the total return on your investment over the long run, the withholding tax charged by foreign tax authorities is relatively small. Especially when most of the foreign companies in your portfolio are growth companies like Apple, Facebook and Tesla, which pay tiny dividends and rather use their spare cash flow to grow their companies. The dividend portion is generally much smaller than the capital gains over the years – and that’s where the big tax saving sits.

Even though it was a bit of a surprise that I do pay tax on my TFSA – on some foreign listings – it’s definitely still worth the zero capital gains tax and other tax-free benefits this side of the border. It was National Treasury and SARS' intention to make a TFSA entirely tax-free. But it seems there’s a limit to SARS’ powers after all.

Extract from conversation with Allan Gray re dividend withholding tax and my TFSA

Dear Miss Steyn

Thank you for your patience in my response.

Dividends withholding tax applicable in foreign jurisdictions The Satrix MSCI World Equity Index Feeder Fund is domiciled in South Africa, however the underlying assets of the Fund are externally domiciled and in terms of the flow of dividends, the holding company’s tax rules would take priority over our tax-free investment legislation in South Africa.

Therefore, you are correct in saying that dividends paid by the underlying companies are taxable in their own jurisdictions. Whether it is the US or Japan or any other country, the taxation rules of dividends in those countries would hold true for companies domiciled in that specific region. The CIS either receives the net of tax amount or it will receive the gross of tax dividend amount and will be liable to deduct the tax on the dividends and pay it over if no withholding principles are used. Thereafter, depending on whether the Fund is a distributing or an accumulation fund, this will determine the next steps. In the case of the Satrix MSCI World Equity Index Feeder Fund, the Fund is an accumulation Fund and so the CIS would simply buy more of the underlying assets.

The conduit principle and dividends withholding tax in foreign jurisdictions Your commentary on the conduit principle is not entirely correct. Feeder Funds effectively invest in another Fund up to 100%, however there is an additional currency element involved. For example, in the case of Satrix MSCI Global Equity Feeder Fund, the Fund invests in the Sanlam World Equity Tracker Fund, which is a USD denominated Fund, however Satrix have selected ZAR as the reporting currency for the Fund. The offshore CIS would either receive a dividend net of taxes from a company or it would receive the full dividend from a company and then effectively have to report this to the tax authority in the country in which either the CIS, or the company that paid the dividend is based in, and thereafter withhold the relevant tax back on the dividends.

The taxation treatment is dependent on the location of the specific CIS and the rules and regulations that govern CIS in a specific country. The taxation of the dividends would be applicable to offshore companies, and therefore expose Feeder Funds to international taxation whereby any distributions received by a client in a Feeder Fund would be net of taxes incurred internationally.

In summary, a tax-free investment is free of any income tax, dividends tax, capital gains tax in the hands of a resident South African on the returns from these investments. However, if the underlying investments are foreign and domiciled in a jurisdiction other than South Africa then that jurisdictions laws will take precedence and may apply any relevant withholding taxes (WHT). This results in the underlying fund receiving a distribution that is net of WHT. This logic applies irrespective of how the product is structured.

I hope that the information provided above sufficiently addresses your questions. If you have any further questions, please contact our Client Service Centre on 0860 000 654 or email us at info@allangray.co.za.

I hope you have a wonderful day further.

Yours sincerely

No 1 Lady Detective client consultant at Allan Gray*

*Real name withheld to respect the privacy of the individual

Dear *

Thanks for the thorough and very clear explanation of DWT on dividends relating to locally domiciled feeder funds. You have answered all aspects of my original question and it feels like we've gotten to the bottom of the query.

As a writer for financial services, I will be more careful in future not to make sweeping statements such as 'no dividends tax applies to TFSAs'. Our local feeder funds clearly have no power over offshore domiciled companies and the offshore domiciled collective investment schemes into which they feed. I rest by that.

What about simply investing in the Allan Gray Tax-Free Balanced Fund, where "the offshore portion of the unit trust is mostly invested in Orbis unit trusts." Is that offshore investment into Orbis also via a feeder fund structure? And would the same principles and process therefore apply as described for the above mentioned Satrix feeder fund?

Kind regards

Lizelle

Dear Miss Steyn

Thank you for your prompt response.

The offshore portion of the Allan Gray Tax-Free Balanced Fund is not obtained through a feeder fund set up. However, the dividends would follow the same principles as previously discussed for the offshore portion of the fund.

If you have any questions, please contact our Client Service Centre on 0860 000 654 or email us at info@allangray.co.za.

I hope you have a wonderful weekend.

Related blog posts

Best TFSA in South Africa

2 February 2020

If there’s only one investment product in your long-term investment portfolio, surely it has to be a tax-free savings account (TFSA). Since TFSAs started in 2015 the number of TFSA providers have grown rapidly, pushing fees down (great for investors). But the levels of service you get with these products vary hugely. Where do you go for the best tax-free account in SA?

How much tax does a TFSA save you?

12 February 2021

A tax-free savings account (TFSA) is a gift from an unlikely benefactor: SARS. Sceptics can be forgiven for ignoring this product, but they are, unfortunately, missing out on significant future tax savings. Exactly how much tax will a TFSA save you?