How much tax could a TFSA save you?

By Lizelle Steyn

8 February 2023

A tax-free savings account (TFSA) is the one investment product that every investor should have. Most investment products have pros and cons, but this one has only advantages – as long as you stick to the R36 000 annual allowance. If you try to invest more than that in any tax year, you’ll get slapped with a 40% tax bill on the excess. But is it worth opening a tax-free account if you’re limited in terms of how much you can put into this product? Really, how much tax could a TFSA save you?

As it turns out, a truckload of tax.

I did some calcs and wrote an article for Sanlam on exactly how much tax a tax-free account could save.

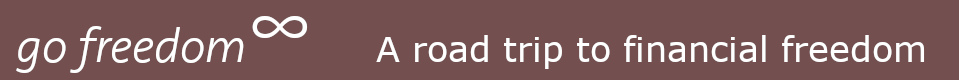

After 20 years, an equity investor could save more than R300 000 in tax

In the example below, an equity investor puts in the maximum allowed every year until reaching his R500 000 lifetime limit, but then keeps the money invested for another six years before cashing it in. Assuming his chosen equity fund grows at 10% p.a. after all fees, after 20 years he’ll have R1 954 757 compared to R1 752 256 if the fund had to pay dividends tax to SARS. On cashing it in, he would save another +/- R140 000 on capital gains tax.

Assumptions: Investor is in the 45% tax bracket | equity fund grows by 10% per year (4% dividends; 6% capital growth)

Source: Sanlam Investments | 1 February 2021

Is the 10% growth assumption reasonable? Based on the past 100 years’ data, yes. Most global equity indices (the local ALSI included) delivered 7% more than inflation. Let’s take 1% off for fund, platform and trading fees (assuming no adviser in the picture), and you’re left with 6% more than inflation on an investment in a typical equity index fund. Assuming inflation hovers around 4% over the next 20 years, you could realistically end up with a 10% per annum return.

If you want to play around with your own investment amounts and time horizon, Walter from HowTaxWorks has build the interactive calculator below.

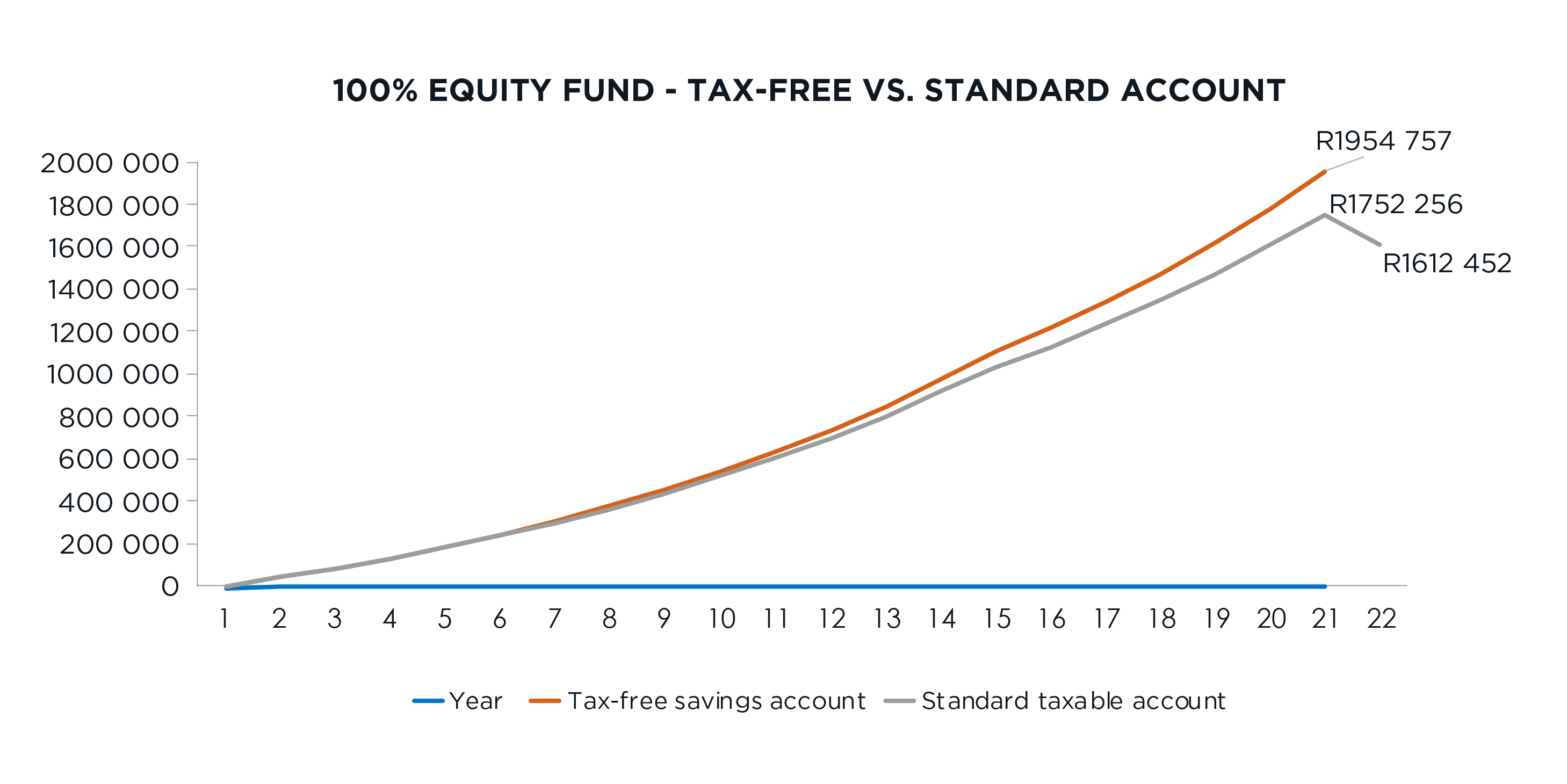

After 20 years, a cash investor could have one-third more in a TFSA

In our second example we have a very conservative investor who prefers to leave even her long-term savings in cash. If she’s in the 36% tax bracket, choosing a tax-free savings account for her cash instead of a standard account would leave her with R1 131 545 instead of R842 708 on an account where she had to pay income tax on her interest. That means that after 20 years, a cash investor in the middle income tax bracket could have one-third more in a TFSA than in a taxable product.

Assumptions: Investor is in the 36% tax bracket | fund pays interest of 6% per year | annual exemption of R23 800 is used elsewhere in her portfolio

Source: Sanlam Investments | 1 February 2021

Other than the tax saving, the second graph also illustrates the lower returns that can be expected from keeping your money in cash or the money market. Cash is meant for the short-term, not long-term savings like a TFSA. But I understand that some investors simply don't have the stomach for any stock market fluctuations.

Tax-free really is a gift

What is the catch? There is no catch. Investing in a TFSA really is a gift. And once you’ve had a glimpse of how much tax a TFSA could save you, it’s painful to watch how much money investors who are still in standard, taxable products is wasting. I wish I could put all my investments into a TFSA. Alas, SARS’ fist slams tight at R36 000 per tax year.

Related blog posts

Best TFSA in South Africa

30 January 2023

If there’s only one investment product in your long-term investment portfolio, surely it has to be a tax-free savings account (TFSA). Since TFSAs started in 2015 the number of TFSA providers have grown rapidly, pushing fees down (great for investors). But the levels of service you get with these products vary. Where do you go for the best tax-free account in SA?

Few things stop first-time investors as dead in their tracks as needing to make a big decision. Most people know they want to invest tax efficiently, but which one of the two most popular tax wrappers should you sign up for: a tax-free savings account (TFSA) or a retirement annuity (RA)?