Coreshares Total World vs Satrix MSCI World and EM

By Lizelle Steyn

19 June 2021

Nowadays, when it comes to any new money that I invest offshore, I like to keep things simple and use only two widely diversified global ETFs - the Satrix MSCI World and the Satrix MSCI Emerging Market (EM) ETF. Recently CoreShares came along and launched a world ETF that combines developed and emerging market stocks. Should I switch and make my global ETF portfolio even simpler, I thought. How does the CoreShares Total World compare to my Satrix MSCI World and EM combo?

Table 1: Coreshares Total World Stock vs. Satrix MSCI World + Satrix MSCI EM

| Satrix MSCI World + Satrix MSCI EM | Coreshares Total World Stock | |

|---|---|---|

| Asset class | Both funds classified as Global equity - General | Global equity - General |

| Number of countries | 23 developed market (DM) + 27 emerging market (EM) countries | 49 DM and EM countries combined |

| Markets | I chose 50% DM via Satrix MSCI World and 50% EM via Satrix MSCI EM | Developed (89%) and emerging markets (11%) |

| Size of companies | Large cap + mid cap; small cap in EM only | Large cap; mid cap; and small cap in DM and EM |

| Number of shares | +/- 4900 | +/- 9000 |

| % of world market | About 90% | About 98% (micro shares and frontier markets excluded) |

| Index tracked | MSCI World (Developed Markets) Index + MSCI Emerging Markets Investable Markets Index (IMI) | FTSE Global All Cap Index |

| Top 5 companies | Apple Microsoft Alphabet Amazon |

Apple Microsoft Alphabet Amazon |

| Top 3 countries | US Japan China |

US Japan China |

| Target total expense ratio (TER) | 0.35% including VAT for Satrix MSCI World; 0.40% for Satrix MSCI World | 0.29% including VAT |

| Transaction cost in the fund (TC) | 0.00% | Not yet known but should be low, being a feeder fund |

| Offshore fund into which it feeds | iShares Core MSCI World UCITS ETF + iShares Core MSCI Emerging Markets IMI UCITS ETF | Vanguard Total World Stock ETF |

| Tax efficiency | Feeds into tax-efficient Irish-based UCITS | 0.13% lower performance than had it fed into an Irish domiciled fund |

Source: gofreedom.co.za | CoreShares | Satrix | The ETF Investor.

Full names of funds are: CoreShares Total World Stock Feeder ETF; Satrix MSCI World Equity Feeder ETF; Satrix MSCI Emerging Markets Feeder ETF

NB: I originally understood from the CoreShares pre-listing fund info sheet that CoreShares quotes fund fees ex VAT, but Gareth Stobie corrected me on 25 June 2021. The targeted TER is in fact inclusive of VAT.

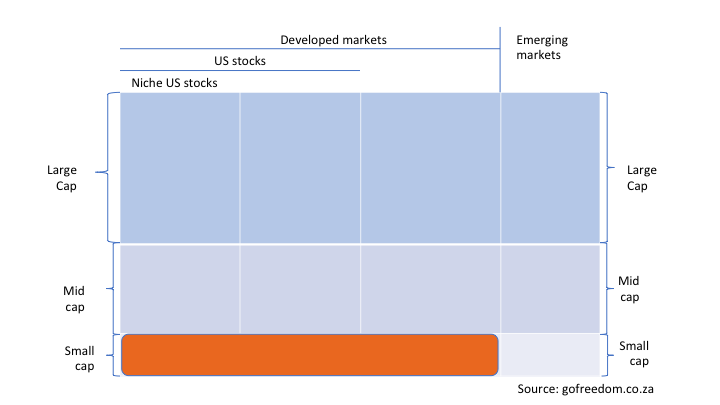

The diversification factor: CoreShares Total World covers DM small caps

The drawcard of the CoreShares Total World is that it covers developed market (DM) small caps too. On the Satrix side, only the Satrix MSCI Emerging Market (EM) ETF covers small caps, not the MSCI (Developed) World ETF. I highlighted in orange below which part of the global market place is not covered by combining the Satrix MSCI World and the Satrix MSCI EM as your offshore portfolio. (For a reminder of which global ETFs cover which parts of the globe and what terms like ‘EM’, ‘large cap’ and ‘small cap’ mean: How to diversify your global equity ETF portfolio like a pro.)

CoreShares targets a lower TER

Always double-check that VAT is included in the TER figure. CoreShares has confirmed that their targeted TER of 0.29% includes VAT, and it is therefore aiming to have lower fund management fees than Satrix. Also remember that actual (not targeted) TER is a historic %, recalculated every quarter, and will vary from quarter to quarter. TER is important, though, and can be a drag on performance. It's the main reason ETFs battle to beat the return of the index that they're tracking. As a side note, always keep in mind that TER is not the only fee you pay for an ETF. (More on how to find all the fees and costs involved with your chosen ETF.)

The CoreShares extra tax will affect performance

The dividend tax withheld by foreign tax jurisdictions (like the IRS) get little attention, but they apply to all three ETFs mentioned here, even when they are 'wrapped' within a TFSA. Actually, every ETF and unit trust fund with foreign stock market exposure pays withholding tax. The exact percentage depends on the jurisdiction of your shares and/or offshore fund into which your local feeder fund feeds. It gets paid away to foreign tax collectors (other countries’ equivalent of SARS) before the foreign dividends hit your investment account. Importantly, it reduces the return of your investment.

The two Satrix global ETFs, which both feed into an Irish-based UCITS fund lose less foreign withholding tax than the CoreShares Total World ETF, which feeds into a US-based fund.

The verdict: CoreShares Total World vs. Satrix MSCI World + Satrix MSCI EM combo

To summarise:

| Diversification | CoreShares Total World is better diversified - includes DM small caps |

| Fees | Expect a slightly lower TER from CoreShares |

| Tax efficiency | The UCITS funds into which the Satrix combo feeds has a better net foreign dividend outcome |

The verdict when you compare the CoreShares Total World and the Satrix MSCI World/EM combo? Both are low-cost, well-diversified choices. Where the Coreshares Total World is more diversified and targets a lower TER, the Satrix combo is more tax-efficient. Personally, I like being able to equally weight developed and emerging markets by using 50% Satrix MSCI World and 50% Satrix MSCI EM in my offshore portfolio. But opting for Coreshares' built-in 89% DM/11% EM split is also good. Both options work well for owning a huge chunk of the world market.