| Financial freedom | Retirement | ETFs |

|---|---|---|

| TFSA | Offshore | Property |

| Markets | Investment terms | Fees |

Topic: Offshore investing

With the JSE making up less than 1% of world stock markets, it makes sense to take at least some of your portfolio offshore. Investing offshore is an essential hedge against a weakening rand too. But how exactly do you go about it? Rest assured, if you're taking less than R1 million per tax year offshore, a lot of the red tape of the past has been removed. Here are 3 easy ways to invest internationally.

A reader asks, "I’ve chosen the Easy Equities platform for my TFSA. I’m also looking at the Vanguard S&P 500 (VOO) or something similar as my chosen ETF. Can I invest offshore with a TFSA?"

And, is it possible to make the S&P 500 70% of my investment and invest the rest more aggressively?

It can be a bit of a headache trying to figure out the difference between the rand return and the dollar return of your offshore investment. Some platforms, like Allan Gray, show your returns in rand. But how do you calculate your rand return when you’re shown a dollar return? And once you’ve handed over your money to your offshore manager, why does a weakening rand become a welcome tailwind?

Nowadays, when it comes to any new money that I invest offshore, I like to keep things simple and use only two widely diversified global ETFs - the Satrix MSCI World and the Satrix MSCI Emerging Market (EM) ETF. Recently CoreShares launched a world ETF that combines developed and emerging market stocks. I've compared the new fund to my existing Satrix combo to find out whether it's worth switching.

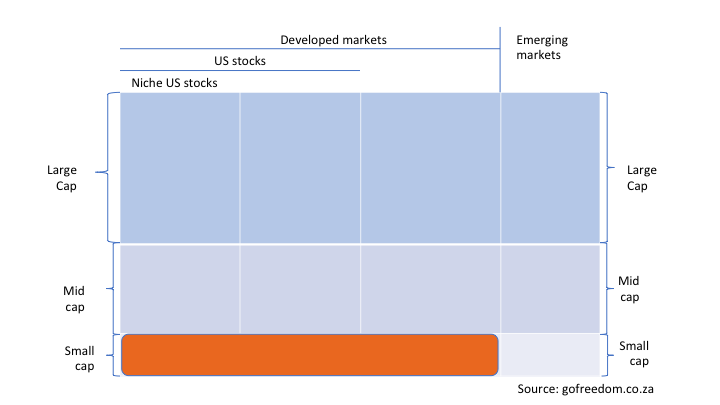

The CoreShares Total World Stock ETF not only combines developed market (DM) and emerging market (EM) countries in one ETF, it also adds global small caps – a first in South Afica. This is a great one-stop ETF for your foreign equity exposure needs. How does it compare to the Sygnia Itrix S&P Global 1200 ESG ETF?

This year I picked a global equity fund for my TFSA and started wondering how the Allan Gray TFSA gets around the dividend withholding tax charged on the offshore listed companies in which I’m invested via the fund. It turns out, there’s no avoiding it. TFSA investors do pay withholding tax on foreign dividends and interest.

I've noted that some of my fellow travellers on the road to financial freedom have the 'swiss army knife' of investments - only one ETF

(exchange traded fund) to do everything for them. It's normally the Satrix MSCI World or Ashburton 1200. But is a portfolio of one ETF enough?

It’s time to delve into some ‘index geography’. Once you can confidently point out where on the global equity index 'map' your ETF lies, knowing how to further diversify your global portfolio becomes a breeze.

Deciding how much to invest offshore is not an exact science. You need to consider your inclination to emigrate, how much time you want to spend overseas if you prefer to stay resident in SA, and a few other factors. This is my first attempt at a formula to help you decide how much to take offshore.

Yes, the JSE makes up less than 1% of the global stock market and you need exposure to other parts of the world, with more opportunities than can be found in SA. Yes, global equity markets have left our stock market returns eating their dust over the past decade. Yes, you should invest offshore. But 100%? I can think of at least 7 reasons why investing 100% offshore is not such a great idea.