An investment blog - teach yourself how to invest

Rated one of the Top 5 Investment Blogs in South Africa by Feedspot (2023)

| Financial freedom | Retirement | ETFs |

|---|---|---|

| TFSA and tax tips | Offshore | Property |

| Markets | Investment terms | Fees |

While searching for the best retirement annuity (RA) in South Africa, you would have heard about the new flexible type of RA. That’s the one you want. And if you’re a fan of passive investing, you’ll also be happy to hear that you now have the option to choose one of these low-cost index trackers as the underlying fund for your new RA. Now where do you go for the best retirement annuity in South Africa?

Tymebank has been onboarding new customers in droves with their competitive rates on short-term deposits. But how safe is your money in a digital-only bank account? Or with any new bank, in fact? These are the most important questions to ask before you take the leap.

A recent savings survey on the impact of money showed that nearly 90% of the South Africans surveyed are stressed and 60% reported being extremely stressed about their finances. Financial stress has become a national affliction. But it doesn’t have to be that way - if we can make choices that don’t put more pressure on us, but create some venting and breathing space. Here are a few ways to ban financial stress from your life for good.

In the words of The Beatles, "Let me tell you how it will be There's one for you, nineteen for me 'Cause I'm the taxman." If you're new to the world of paying tax, make sure you use all your tax deductions while always staying on the right side of the taxman.

Tia says, "I’m self-employed and enjoy my work. Even though I’m fit and healthy, I’m thinking I should get a back-up plan and make sure I no longer need to work by age 65." Tia is 50 and by most standards a late starter to financial freedom. She has zero retirement savings. Is it too late for her to reach financial freedom?

“Whether you think you can or think you can't, you're right” - Henry Ford

Fortunately, I caught sight of my own negative money beliefs early enough to change my subconscious programming in time to avert a lifetime of not being happy at work. Here are 7 beliefs that can turn your whole life around for the better.

I didn't make a big fuss about reaching financial freedom, but it's a pretty good feeling. It's been a year now since I've left corporate employment to rest, play, and set off in a new direction. Thankfully, my expenses have stayed under control and my portfolio feels moderately stable with a cash buffer built in. This is my annual financial freedom review and a few thoughts on reaching that big financial freedom goal.

With the JSE making up less than 1% of world stock markets, it makes sense to take at least some of your portfolio offshore. Investing offshore is an essential hedge against a weakening rand too. But how exactly do you go about it? Rest assured, if you're taking less than R1 million per tax year offshore, a lot of the red tape of the past has been removed. Here are 3 easy ways to invest internationally.

Thinking about our own death and that of our partner or spouse needn't be morbid. In fact, it can spur us on to make the most of our time together, to live fully, and to be kind to one another. Having a valid Will in place is part of being kind to our loved ones. To make the right estate planning decisons we need to know the basics about estate duty, capital gains tax on death and other costs linked to our estate.

Education plans - how do you choose between the different types of products available? Does your child get control over the money when they turn 18? What happens to the investment should you die? And how much tax would you pay? These are just some of the questions we address in this blog post on saving on behalf of your child.

On Go Freedom we love to talk about how to achieve financial freedom. Or "retirement", if that's what you prefer to call leaving behind a salaried life or business you don't enjoy running. But is it possible to achieve this without paying any income tax in retirement? We did some calculations, and the results are surprising.

Saving tax-free, opening an investment account with only R1, investing offshore without an offshore bank account... None of these things were possible 10 years ago. While we haven't reached investor nirvana yet, there is much progress to celebrate.

We look at the 5 biggest game-changers for South African investors over the past decade.

A reader asks, "I’ve chosen the Easy Equities platform for my TFSA. I’m also looking at the Vanguard S&P 500 (VOO) or something similar as my chosen ETF. Can I invest offshore with a TFSA?"

And, is it possible to make the S&P 500 70% of my investment and invest the rest more aggressively?

Just when we thought the Finance Minister didn't have much room to maneuvre and hand out any gifts, he surprised us. No transfer duty is payable now on the first R1.1m of any property purchase. And, on retirement, investors can now enjoy zero tax on the first R550 000 of the lump sum amount taken. What about the other taxes and limits that investors need to be aware of?

If there’s only one investment product in your long-term investment portfolio, surely it has to be a tax-free savings account (TFSA). Since TFSAs started in 2015 the number of TFSA providers have grown rapidly, pushing fees down (great for investors). But the levels of service you get with these products vary hugely. Where do you go for the best tax-free account in SA?

Low interest rates during lockdown and stimulus handouts in countries such as the US fuelled a bubble in the markets that had to burst at some point. The shimmering orbs imploded spectacularly in 2022 with the S&P 500 down 15% and the tech-heavy Nasdaq down 26% for the year. South Africans with most of their portfolio offshore would have felt the most pain, while those who stuck to local funds can count themselves lucky if their portfolio beat inflation. My own portfolio grew by 7% but most of that came from adding more to the 'pot'.

For most people, a tax-free savings account (TFSA) is their first long-term investment product. If you can also invest at low fees, that's a double whammy. But low fees are not the only thing to consider when looking for the best tax-free account in SA. There are also other criteria, which may sway you towards a slightly more expensive product. Let's compare 5 of the most popular TFSAs in South Africa.

Higher inflation looks like it’s going to be around for at least another year. Unless your earnings grow at the same pace, inflation will eat away at your purchasing power. Fortunately, you are not powerless and there are plenty of ways to soften the blow. Here are the top 6 ways in which I try to inflation proof my life.

Many of us have lost parents, siblings, partners and friends during the pandemic. I know so many people who were not prepared for the backlog at the Master’s Office and for how long it can take for an estate to be wound up. This post is about the very basics of estate planning - creating cash flow for the months following death.

Tax can get complicated, especially when you invest in foreign companies and ETFs. But if you largely steer clear of standard taxable investment accounts, you only need to remember a few things to easily navigate your path through the tax landscape. I share a recent podcast and my tax talk on the Easy Equities 'Invest for your Future' webinar with you.

It's been a good year in the market. Most of my funds gave a return of more than 20%. And when the sun shines in the markets, it shines on everyone. As I suspect was the case for most of you, my portfolio saw a strong growth spurt in 2021. And with my travel expenses contained by the restrictions of a pandemic and the weight of quite a lot of work on my plate, I found myself buoyed closer to financial freedom.

Satrix gave South Africans their first ETF - the Satrix 40 - in 2000, making it possible to own 85% of the SA stock market back then. On 10 November 2021 Satrix launched another ETF - the Satrix Capped All Share ETF - that makes it possible to own even more of the SA stock market. If you already have the Satrix 40 in your portfolio should you switch?

It can be a bit of a headache trying to figure out the difference between the rand return and the dollar return of your offshore investment. Some platforms, like Allan Gray, show your returns in rand. But how do you calculate your rand return when you’re shown a dollar return? And once you’ve handed over your money to your offshore manager, why does a weakening rand become a welcome tailwind?

A book that contains everything you need to know to become your own adviser is an ambitious project and Warren Ingram did a great job at providing a high level picture in under 200 words that’s accessible to anyone who’s starting their quest for financial freedom. There are a few aspects of investment planning which I approach differently from Warren, though.

Last month I did a comparison in the search for the best RA in South Africa. A preservation fund comparison seemed like the logical next step. Currently, the number of preservation funds available for investors who prefer low-cost index trackers is smaller than that for RAs. But you do have some good choices if you’re looking for the best preservation fund in South Africa.

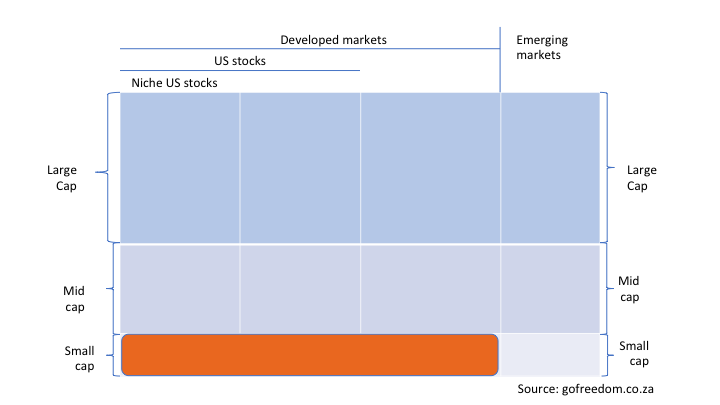

Nowadays, when it comes to any new money that I invest offshore, I like to keep things simple and use only two widely diversified global ETFs - the Satrix MSCI World and the Satrix MSCI Emerging Market (EM) ETF. Recently CoreShares launched a world ETF that combines developed and emerging market stocks. I've compared the new fund to my existing Satrix combo to find out whether it's worth switching.

When the time comes to leave your employer, preserving as much as possible of your retirement savings for your actual retirement is a priority. But you might need some of the money urgently. How much should you withdraw and how much should you preserve? And to whom and which product should you transfer it: RA or preservation fund? You have more options than you think.

For most of us on the road to financial freedom, the idea is not to stop working, but to not work so hard and only on the jobs we love. The economist Keynes forecast that working to solve for economic scarcity would be a thing of the past by now for all humans, freeing us up to enjoy as much leisure time as we need. Still we’re stuck with a 40-hour work week. Why is this?

The CoreShares Total World Stock ETF not only combines developed market (DM) and emerging market (EM) countries in one ETF, it also adds global small caps – a first in South Afica. This is a great one-stop ETF for your foreign equity exposure needs. How does it compare to the Sygnia Itrix S&P Global 1200 ESG ETF?

This much we know is true: at the first level, the fund level, an ETF is almost always cheaper than a unit trust tracking the same index. But at the next level, the trading platform or product level, access fees need to be added to the ETF costs for a fair comparison, as it’s impossible to buy an ETF without this next level of fees. Comparing ETF and unit trust fees at fund level only is a very common mistake.

Mr Money Mustache, the Frugalwoods and almost every FIRE blogger I know choose index tracking funds (passive) for their investment portfolios. This ‘everybody is doing it’ argument is not the one that convinced me to start switching into passive, though. But when Warren Buffett started recommending index trackers, I found myself paying attention.

This year I picked a global equity fund for my TFSA and started wondering how the Allan Gray TFSA gets around the dividend withholding tax charged on the offshore listed companies in which I’m invested via the fund. It turns out, there’s no avoiding it. TFSA investors do pay withholding tax on foreign dividends and interest.

The FIRE movement sometimes makes the mistake of thinking that 'early retirement' is the only way to gain financial freedom. But there are other recipes for earning an income and being free. The one key ingredient in all recipes for sustained financial freedom, though, is being able to live below your means.

There are a few misconceptions around ETFs vs unit trusts going around. One is that an ETF is passive and a unit trust is always active. The other more worrying untruth is that ETFs are always cheaper than unit trusts. When looking at the overal cost on fund and platform or brokerage level, a unit trust often beats an ETF cost-wise. Which should you choose: ETF or unit trust?

I've noted that some of my fellow travellers on the road to financial freedom have the 'swiss army knife' of investments - only one ETF

(exchange traded fund) to do everything for them. It's normally the Satrix MSCI World or Ashburton 1200. But is a portfolio of one ETF enough?

A tax-free savings account (TFSA) is a gift from an unlikely benefactor: SARS. Sceptics can be forgiven for ignoring this product, but they are, unfortunately, missing out on significant future tax savings. Exactly how much tax will a TFSA save you?

It’s time to delve into some ‘index geography’. Once you can confidently point out where on the global equity index 'map' your ETF lies, knowing how to further diversify your global portfolio becomes a breeze.

Deciding how much to invest offshore is not an exact science. You need to consider your inclination to emigrate, how much time you want to spend overseas if you prefer to stay resident in SA, and a few other factors. This is my first attempt at a formula to help you decide how much to take offshore.

Yes, the JSE makes up less than 1% of the global stock market and you need exposure to other parts of the world, with more opportunities than can be found in SA. Yes, global equity markets have left our stock market returns eating their dust over the past decade. Yes, you should invest offshore. But 100%? I can think of at least 7 reasons why investing 100% offshore is not such a great idea.

While the unit trust industry has too many balanced multi asset funds, the ETF industry has significantly less to choose from. And maybe you're not a fan of any of the brands that put those index tracking balanced funds together. You'll need to do more research and it's clearly more work, but if you'd rather build your own multi asset ETF portfolio, this is how you go about it.

Let’s face it, the unit trust industry has way too many funds. Arguably, the ETF industry is heading the same way. The choice of which underlying fund to pick for your account is overwhelming for new and old investors alike. How do you methodologically go about choosing an ETF or unit trust fund you feel confident is the right one for you?

The FIRE movement has become obsessed with choosing funds with the lowest fees. But are we forgetting the main driver of portfolio performance - asset allocation? 2020 has been an excellent example of how different asset allocation choices can lead to wildly different investment returns.

Few things stop first-time investors as dead in their tracks as needing to make a big decision. Most people know they want to invest tax efficiently, but which one of the two most popular tax wrappers should you sign up for: a tax-free savings account (TFSA) or a retirement annuity (RA)?

This is my favourite blog post of the year. Probably because 2020 has been an exceptional year in terms of moving towards my financial goals. When I started this blog, I was 52% on my way to financial freedom. As of today, that figure stands at 75%. What made such a big leap possible?

Selling all three my previous properties privately has saved me nearly R200 000 in estate agent commission over the years. Yes, selling privately is not for everyone, but the percentage of private sales in this country is much lower than the percentage of people who have the power to go this route. What are the hoops you have to jump through and who are your magic helpers on the way to a private sale?

Over the past 13 months our country's repo rate has dropped from 6.75% to 3.5%. It’s unusual to get a better interest rate than the repo rate on a notice deposit with your bank. For example, Nedbank currently offers 3% on a notice deposit for amounts above R50 000. TymeBank offers 4% from the first day that your money hits their Goalsave account. In comparison, African Bank offers 10% per year on a 5-year fixed deposit. Why the big difference?

For all lockdown's craziness, it did speed up the manifestation of two of my longtime dreams: working from home indefinitely and moving to the platteland. The past four years have been a busy time for me on the property front, involving buying twice and selling twice - all done privately. It was fun and along the way I also picked up some tips for first-time property buyers.

There are two types of investors at the moment. The one group still has a smile on their face and go about life as normal. The other group looks like they've just been thrown off the bus. The difference between the two? The first group has not yet checked their investment accounts... How did this market crash happen? And how long will it be before life and our portfolios return to normal?

If there’s only one investment product in your long-term investment portfolio, surely it has to be a tax-free savings account (TFSA). Since TFSAs started in 2015 the number of TFSA providers have grown rapidly, pushing fees down (great for investors). But the levels of service you get with these products vary hugely. Where do you go for the best tax-free account in SA?

It's a new year and my blog needed a new name - easier to remember, accurately describing a journey to freedom, and now a proudly South African domain. Welcome to Go Freedom!

It’s almost six months since I launched this website and time for an update on my journey to financial freedom. It’s been a mostly smooth drive since June and my overall feeling is one of being hopeful. If this update was a song, it would be Jenn Johnson's 'You're gonna be OK'.

Fees need to be hunted down no matter how deep they’re hiding and cut if they’re for a service that adds no value to your life. So, how do you find out how much you’re really paying? Well, start by looking out for the three A’s of investment fees - advice, admin and asset management - and pin those hairy figures down.

Want to know where active, passive, wrappers, unit trusts and other commonly used investment terms fit into your portfolio? This is for investors who want to dig deeper. Warning: this post contains explicit investment language and graphic depictions of what your money get ups to when you hand it over to the investments industry. Only view if you're not sensitive to a sustantial amount of detail.

This blog post is for everybody out there who’s ever played around with a retirement calculator and then got stuck halfway trying to figure out whether they’ll be OK in old age or not. Because investment terms are not that obvious - even for insiders. This week I'm walking you through the Discovery tool step by step.

It seems most corporate employees - myself included - become burrowed so deeply into areas of specialisation that they hardly catch a whiff of the exciting new developments in their industry. Being on sabbatical allowed me to explore what’s new on the local investment scene. My heart missed a beat. How and when did I fall this much behind? And likewise for my portfolio performance...

Let's face it. It's hard to relax on holiday when your wallet aches every time you want to do, see or eat something. But there are ways to see the world that fit most budgets. Here are some frugal travel tips for those who need to find out what's on the other side of the fence.

Soon we’re off to Greece for our second holiday this year. Partly possible because I haven't bought a new car in almost 17 years, but also because I've spent the past few years trimming down my running costs to the bare minimum that would work for me. This is how I manage living below my means. Well, for most of the year.

Are there routes to your financial freedom magic number other than the 4% rule or rule of 300? Because 300 times your monthly expenses is kind of a tall order and maybe you are feeling somewhat 'flat tyres' after reading the previous two posts. Time to look at other formulas that could work better for you when considering how much is enough?

Four things that can go wrong with the 4% rule

The 4% rule is a great guide towards your magic number - if you keep in mind that it's a rule of thumb and like all simplification it has the potential to trip you up if you're not aware of its shortcomings. Here are the four main possible 'wobblies' you need to prepare for.

The 4% rule / rule of 300 - how to calculate your magic number

If your GPS is set on financial freedom, that place where you can just be for a while and march to your own beat, you'll need to know your magic number. The amount at which you can say, 'If I quit my job now, I'll be OK for a very long time.' Fortunately, you don't need complicated maths - if you use the 4% rule or rule of 300.

Why I (sometimes) fake financial freedom

It can no longer be postponed. After more than seven years since my last one, and five years with Big Investments Group (B.I.G.), air punching and silently screaming behind closed doors, I’ve lined up a sabbatical. Two months out of the office. Out of reach. Released from duty. Free to do-be-do.

Will we live a long, long time?

According to legend, if you look into the Well of Reflection at the cemetery of the sacred temple village of Koyasan and do not see your own reflection, you will die within three years. So it happened that I contemplated my own mortality every step of the way back into the village, feeling a little pale and unsettled. I don’t know if it were the clouds that added to the illusion, but for the life of me I could not see my own reflection.