Tax and how to avoid it as an investor

By Lizelle Steyn

9 March 2022

Tax is a pain, but the good news is that by being organised and investing in the right products you can remove most of the sting. E-filing opens in July every year but the tax year runs from 1 March to 28 February, important dates if you don't want to miss the cut-offs for each year's allowable contributions to your tax-free savings account and RA.

What are all the taxes an investor pays?

The list below includes most of the taxes an investor could potentially end up paying:

- withholding tax on local dividends

- withholding tax on foreign dividends - withheld by foreign tax authority

- dividend tax charged locally by SARS on net foreign dividends after portion withheld by foreign tax authority

- income tax on local interest over the amount of R23 800 for under-65s

- income tax on foreign interest

- income tax on local rental income

- income tax on foreign rental income

- capital gains tax

- securities transfer tax

- VAT on investment fees

Some of those taxes, like the withholding tax on local dividends, as well as securities transfer tax and VAT, are deducted from the portfolio or investment account and there's no need to 'pay in' these taxes when e-filing. Listen to the interview with DJ@Large below to hear more about how much tax investors are paying when they're not using a tax-free savings acccount or retirement annuity.

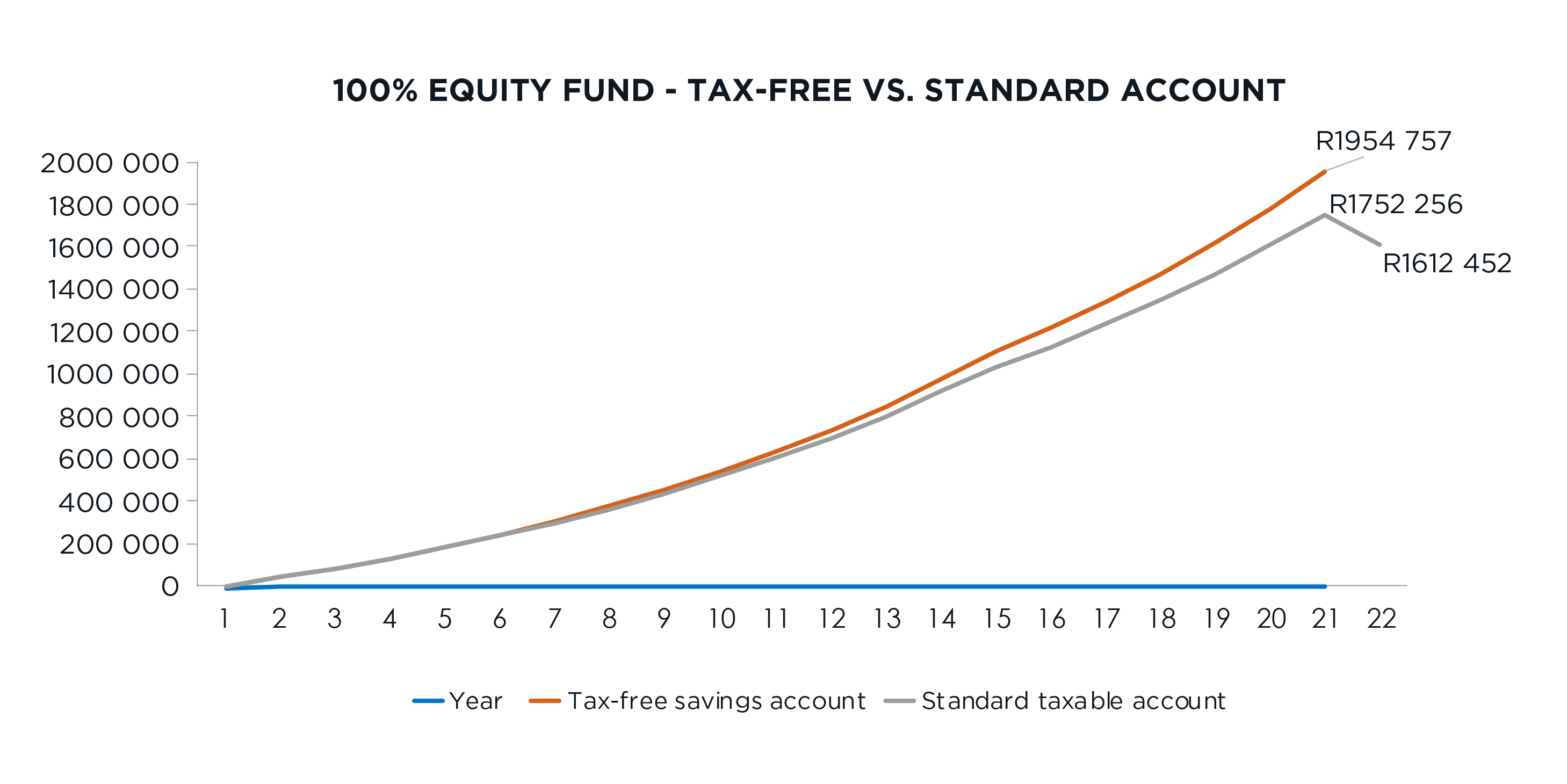

In the podcast I mentioned how much tax a tax-free savings account (TFSA) can save you, assuming:

- you invest the full R36 000 allowed every tax year

- you keep that up until you reach your lifetime limit of R500 000 after 14 years

- you leave the money invested in your TFSA for another 6 years, to make up a 20-year investment term

- your investment returns 10% per year, of which 4% is dividends and 6% capital growth

- the dividends tax rate remains 20%

- you cash in the investment at the end of 20 years when your marginal tax rate is 45%

After 20 years, an equity investor using a TFSA could save more than R300 000 in tax

In the example used, after 20 years you’ll have R1 954 757 compared to R1 752 256 if dividends tax was payable. On cashing it in, you would save as much as another +/- R140 000 on capital gains tax if you're in the 45% tax bracket. If you're in the 26% tax bracket, for example, then the capital gains tax you save will be closer to R80 000.

Assumptions: Investor is in the 45% tax bracket when cashing in the investment | equity fund grows by 10% per year (4% dividends; 6% capital growth)

A retirement annuity is another great product to save tax

Once you're able to invest R36 000 into a TFSA every year, your next tax hero product to start contributing to is a retirement annuity (RA). They have so many tax benefits at different stages of the investment. Just bear in mind that one day you will be paying normal income tax on the annuity income from all your retirement products. Thank you to Easy Equities, for the opportunity to speak at their 'Investing for your Future' webinar - more details about how the tax on an RA works in the video clip below:

Tax can get complicated, especially when you invest in foreign companies and ETFs. But if you largely steer clear of standard taxable investment accounts, you only need to remember the following to navigate your path through the tax landscape:

- The first R36 000 of your annual savings need to go into a TFSA.

- If your budget is tight and you are unable to save, but you have standard taxable accounts with similar unit trusts and ETFs to what's available in a TFSA, you can withdraw up to R36 000 per tax year from them and move that money over to your TFSA. Keep on doing that every year until you have no more money left in taxable accounts. Remember to reinvest that money in your TFSA as soon as possible to minimise time out of the market.

- Remember that the tax year for your TFSA contributions run from 1 March to 28 February the following year. Stick to the R36 000 limit during that cycle.

- If you're in a position to invest more than R36 000 per tax year, open an RA and contribute as much as you can. (There's no penalty if you go over a certain limit.) Remember that, under normal circumstances, you can't touch this money before age 55.

- If you earn a salary and have a debit order set up for your RA every month, tell your employer about it and find out if your payroll administrator can reduce your tax on your payslip so you get a bigger net salary every month for contributing to an RA.

- Keep all your tax certificates for your TFSA and RA and check that the figures on the certificates line up with what SARS pre-populates your tax form with when you e-file (tax filing season normally opens in July every year).

- A TFSA and an RA are long-term products. They're not for emergencies. You'll need a seperate money market account or short-term deposit to keep your money for emergencies separate from your long-term savings. If you're under age 65, you can earn up to R23 800 interest on that account before you start paying tax on it. Older savers can earn even more interest before they start paying tax.

- If you also hold shares outside of a TFSA in a normal taxable share trading account, try and hold them for at least 3 years. The profit on shares sold after 3 years or more count as a capital gain and not income, according to s 9C of the Income Tax Act.

Related blog posts

Best TFSA in South Africa

31 Jan 2023

If there’s only one investment product in your long-term investment portfolio, it has to be a tax-free savings account (TFSA). Since TFSAs started in 2015 the number of TFSA providers have grown rapidly, pushing fees down (great for investors). But the levels of service you get with these products vary. Where do you go for the best tax-free account in SA?

Best retirement annuity (RA) in South Africa?

7 Feb 2023

While searching for the best retirement annuity (RA) in South Africa, you would have heard about the new flexible type of RA, not the old type sold by insurers and which can have exorbitant high marketing fees. And if you’re a fan of passive investing, you’ll also be happy to hear that you now have the option to choose one of these low-cost index trackers as the underlying fund for your new RA. Where do you go for the best retirement annuity in South Africa?