Basic estate planning - leaving cash behind

By Lizelle Steyn

11 May 2022

Photo credit: Brett Sayles

On 31 July last year my Dad passed away. It was only afterwards that I realised exactly how much I still needed him in my life. His daily whatsapps and emojis (which he only learned to use in the last two years of his life) kept my heart warm. His cheerful nature and resiliance in the face of financial and other difficulties inspired me. Knowing how proud he was of every seemingly insignificant small thing I achieved – even just my first home-grown potato - motivated me, and his daily prayers carried me. There is the odd day that I catch myself almost looking forward to death, just to be reunited with him. Fortunately, that passes quickly. He would have hated me living my life that way. And besides, I still have work to do here.

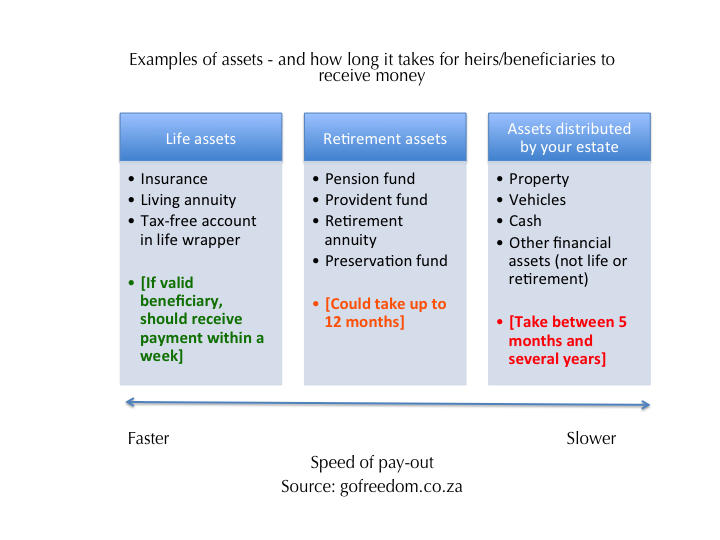

Many of us have lost parents, siblings, partners and friends during the pandemic. My Dad had an Allan Gray living annuity that paid out to my mother within days of notifying them, but I know so many people who were not prepared for the backlog at the Master’s Office and exactly how long it can take for an estate to be wound up. So, this post is about creating cash flow for the months following death.

Why is cash outside your estate so important?

In life, we use cash for easy liquidity, meaning the money is always available at short notice. But as soon as a bank or other financial institution receives a notification of death, that account is frozen. Your bank account and other financial assets go into your estate and become unavailable to family members until the executor of the deceased estate has wound up your estate, needing the authority of the Master of the High Court. That could take anything from five months to several years. But the bills linked to your property don’t stop after death. If you own a property, the municipal bills will keep on coming. The electricity needs to be paid, and the garden and the house would need to be cleaned and maintained. That’s in a best case scenario where you have no financial dependants. If you do have dependants, they will be at a loss in terms of their own living expenses as well.

Retirement products are great in the sense that they don’t go into your estate, saving you estate duty, but they’re definitely not a solution for a quick cash pay-out. That’s because the trustees get up to 12 months, by law, to investigate whether you had any dependants other than the person whom you nominated as your beneficiary, before they will make any payments. Retirement fund trustees are normally very thorough in their investigations, which inevitably is time-consuming.

That is why you need a product that can release cash outside of your estate to the person with whom you have arranged to keep on paying your bills and dependants’ bills after your death. And you need that to happen fairly quickly.

Fortunately, there are ways to provide cash within a few days after your death. I list the 3 simplest products here.

3 Ways to free up cash quickly after death:

Life product #1 – a life insurance policy

This could be a funeral policy which pays out cash or a normal single life insurance policy. The most important thing is to check every year that the nominated beneficiary is still valid. A common example of an invalid beneficiary is someone who has already passed away but the policyholder forgot to amend the policy. Without a valid beneficiary, the amount insured is paid into the estate and gets locked up with all the other assests until the estate is wound up.

If you’re employed, your employer might deduct a compulsory premium from your salary every month for group life cover (life insurance). If this is the case, check that the beneficiary your employer has on record is still valid. Ideally it should be the person with whom you have an agreement to keep on paying your bills or look after your children while the estate is not yet wound up.

If you have a home loan, a separate life insurance policy for the amount you still owe is a good idea to make sure your debt is settled when you pass away. It needn’t be a ‘for life’ policy. Buying a life product that only covers you for the term of the bond – usually 20 years – should be cheaper than a ‘for life’ policy. To get this cheaper type of insurance, get a quote for ‘term insurance’ on your bond from your preferred insurer.

Life product #2 – a TFSA inside a life wrapper

Buying life insurance on your own life is a selfless act. You are never going to benefit from it in this lifetime, and I can understand that many people may be reluctant to sign up a debit order for an insurance product. There is a more palatable alternative, though. A tax-free savings account (TFSA) is the one investment product every South African should have. Most TFSAs will not solve your cash issues post death, as they will also become stuck in your estate. What you need if you want to both make provision for yourself during your own lifetime and create some liquidity in case you pass away before you can enjoy your savings, is specifically a TFSA inside a life wrapper. Allan Gray is very clued up on estate planning and they're one example of a service provider who have structured their TFSA this way.

It should pay out to your beneficiary within days of notification of your death. As with a life insurance policy, you need to keep your nominated beneficiary up to date on a TFSA inside a life wrapper. If the beneficiary is invalid at death, the value of the TFSA will be paid into your estate, and be stuck for as long as your estate might take to wind up.

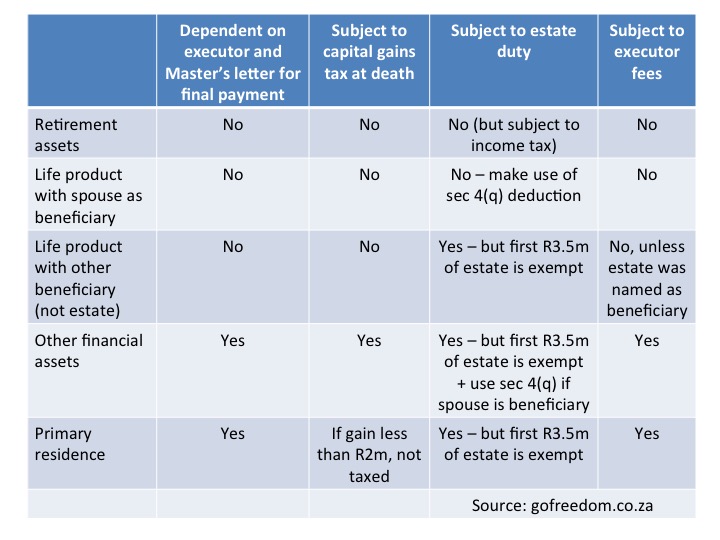

If the beneficiary is your spouse or life partner, they don’t have to worry about esate duty on the amount received. (A section 4q deduction applies.) Anybody else needs to be prepared to pay over the required estate duty on the value of the TFSA when the executor requests it.

As a TFSA has an annual contribution limit of R36 000 currently, it might take a few years to save up enough cash flow for the first year following your death, to sufficiently help those who will need it while your estate is ‘in progress’.

Life product #3 – A living annuity

If you’re older than 55 and have retirement fund products, you have the option to turn one or more of them into a living annuity. Examples of retirement fund products are:

- Retirement annuity

- Pension fund

- Provident fund

- Preservation fund

Currently, with a living annuity, the minimum income you can withdraw from it per year is 2.5%. (The max is 17.5%.) So, you wouldn’t ‘convert’ your retirement fund to a living annuity unless you want to start drawing from your savings for retirement or semi-retirement. If you are in such a fortunate position, your beneficiary will also be well taken care of should you pass away, as your living annuity will be paid to them relatively quickly.

A living annuity also falls under the Long-term Insurance Act, like insurance policies, which is why I classify it in the diagram above as a ‘life product’. It has the added benefit above a life insurance policy, though, in that it’s explicitly exempt from estate duty.

Full estate planning requires a financial planner

What we’re touching on in this article is only the very basics of estate planning - providing some cash flow outside your estate for your loved ones while your estate is being administered. Full estate planning requires someone to help you set up a trust if you have minor dependants and to calculate exactly how much capital gains tax, estate duty and executor fees your estate will owe should you pass away now, and providing enough liquidity inside the estate to cover those liabilities.

Still, if you can make even just the first 12 months easier for those you’ll be leaving behind, by providing cash outside of the estate, that’s already an achievement.