Financial freedom and the four cashflow quadrants

By Lizelle Steyn

4 March 2021

Credit: Andrea Piacquadio

The most common definition of ‘financial freedom’ is being able to live the life you want on your own terms. Financial freedom could involve doing paid work, volunteering, or no work at all. There are no rules for how you choose to spend your time. Generally, the FIRE movement follows the recipe of living frugally and saving aggressively so that it’s possible to retire earlier than normal, leaving enough time to enjoy this freedom. But there are also other recipes for financial freedom, like finding the work you love, work you never want to stop doing. In essence, you’re already financially free when you earn enough and you leap out of bed excited about your day. What other recipes are there for financial freedom?

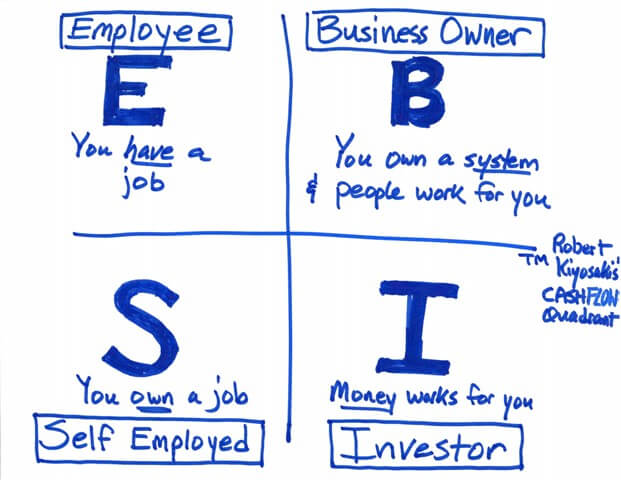

Robert Kiyosaki’s four cashflow quadrants

Winning the Lotto or inheriting are other ways to financial freedom. But because it relies on Lady Luck and other people whom you can’t control (who knows what surprises might be in that Will), these two recipes tend to flop. One model that comes in handy when analysing the different ways in which people take control and provide an income for themselves is Robert Kiyosaki’s four cashflow quadrants.

Credit: Robert Kiyosaki

The quadrants are self explanatory, but it’s worth spending some time on the self-employed quadrant. This is often incorrectly called ‘running your own business’. But according to Kiyosaki the true definition of a business is one that can continue without you, while still providing you with an income. The test is stepping away for a year. If the business continues to run smoothly and provide you with an income, it’s truly a business; if not, you’re in the self employed quadrant. You still need to give your time in exchange for an income.

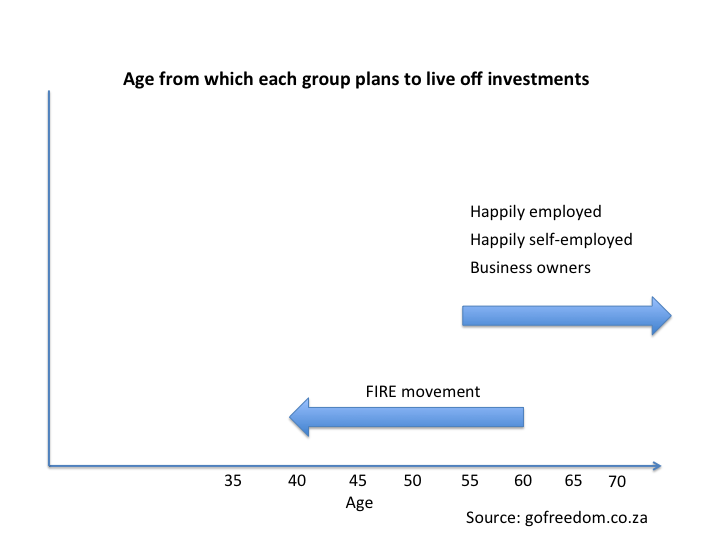

If holding a specific job or running your own business is something that you enjoy and can see yourself doing for the rest of your life, and you’re earning enough, you’re already financially free. Those in the FIRE movement have not yet carved out that niche job or business that pays enough. That’s why they’re driven to ‘retire’ as soon as possible from the work they have to do so they can do the work they love to do. The FIRE movement is saving aggressively so they can live off their investments from a relatively young age.

In contrast, the happily employed, self-employed or business owners who are already doing what they love want to push their retirement age to as late as possible. Here I think of a gentleman in my office who was highly competent, but asked to retire at age 80 – 20 years after the company’s normal retirement age. He agreed but asked to still come into the office a few days a week just to read the paper, give some advice and be in his beloved work environment. I also have a friend aged 81 who is a self-employed Alexander Technique practitioner and who still drives from town to town to do her skilful, much needed work. Aiming to have enough investment income to retire early is but one recipe for financial freedom. Other cashflow quadrants might want to retire as late as health and circumstances allow.

Happy workers have a few advantages above the FIRE movement

Because the happily employed, happily self-employed and successful business owners are in no hurry to retire, they have two important advantages above the FIRE movement:

- They will spend less time in retirement and therefore need a smaller retirement savings ‘pot’.

- They have more time to save and contribute towards their retirement savings pot.

As a result, they don’t need to save as aggressively as the FIRE movement. Exactly how much they need to save of their income every year will depend on the individual’s unique circumstances. As a rule of thumb, the old school advice of saving 15% of your income from the first rand you earn and doing that throughout your working life should suffice.

Successful business owners, who have built a system with competent employees providing them with an income even when they step out of the business, have even less pressure on them to contribute to the traditional retirement savings pot, as their business should be able to supplement their personal retirement income. They still need to save and invest, though.

The investment goals and strategy of each cashflow quadrant will therefore look quite different.

Table: The four cashflow quadrants, their investment goals and strategy

| You’re happily employed | You’re happily self-employed | You’re a business owner | You’re an investor on the FIRE road | |

|---|---|---|---|---|

| Your plan | Work as long as you can | Work as long as you can | Build a strong brand and leadership team that can continue without you | Grow your portfolio so you can stop working and live from your investment ASAP |

| Long-term investment goal | You need 240x your monthly expenses at age 65 | You need 240x your monthly expenses at age 65 | Keep on earning a dividend from your own business; Separate from your business, you need at least 200x your monthly expenses at age 65 | You need 300x your monthly expenses by age 55 |

| Strategy | Save 15% of what you earn into a TFSA/RA | Save 15% of what you earn into a TFSA/RA | Save at least 10% of your business withdrawals/ dividends earned into a TFSA/RA | Save 30% of what you earn into a TFSA/RA |

I’ve used 65 as the ‘normal’ retirement age in the table above, because that’s the age after which an income protection policy will no longer cover you; insurers are basically saying ‘you should have provided for yourself from age 65.’ And 65 is approximately the age from which serious illnesses start featuring, so serious that it takes people out of their jobs or businesses for long periods of time. It’s also the age from which you qualify for the pensioner’s grant from the State.

All four income quadrants need to invest

In the end, it doesn’t matter whether you pursue financial freedom through the job you love, through a successful business or via the FIRE route. All income quadrants need to invest in a well diversified portfolio, because:

- A job can be lost

- Entire professions disappear (remember travel agents?)

- A once successful business can still fail

- Your health may deteriorate

- Your energy may wane as you grow older

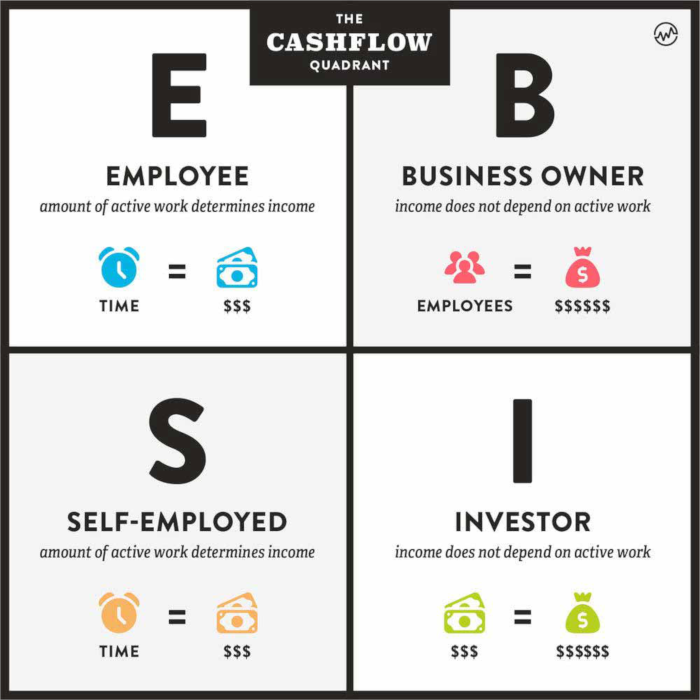

As the image below shows, only the two quadrants on the right lead to so-called 'passive' income. If you’re employed or self-employed (time = money), you need to actively earn your income. And if something happens so you’re no longer able to exchange your time for an adequate income, your entire plan to just keep on working as long as you can, fails.

Credit: Robert Kiyosaki

The reality for business owners is that there are so many reasons a once successful business might fail, naming only a few:

- Your market shrinks due to demographic changes

- Competitors crowd you out

- Your management team walks out to become your competitor

- Innovation makes your product or service redundant

- Your supply chain is disrupted

- Legislation becomes prohibitive

Eventually everyone needs at least a TFSA or an RA

Whether saving 10% or 15% or 30% of your income is appropriate, all four cashflow quadrants need a well diversified tax-free savings account and/or retirement annuity to secure their financial freedom. Every chef has that one ingredient without which they cannot cook. For some it’s olive oil, for others butter or cream – or wine. In the quest for sustained financial freedom and independence, that ingredient is the same for everyone: consistently living below your means and investing, investing, investing.

Related blog posts

The 4% rule / rule of 300 - how to calculate your magic number

26 July 2019

If your GPS is set on financial freedom, that place where you can just be for a while and march to your own beat, you'll need to know your magic number. The amount at which you can say, 'If I quit my job now, I'll be OK for a very long time.' Fortunately, you don't need complicated maths - if you use the 4% rule or rule of 300.

How much is enough?

15 August 2019

Are there routes to your financial freedom magic number other than the 4% rule or rule of 300? Because 300 times your monthly expenses is kind of a tall order and maybe you are feeling somewhat 'flat tyres' after realising how far you have to go. Time to look at other formulas that could work better for you when considering how much is enough.